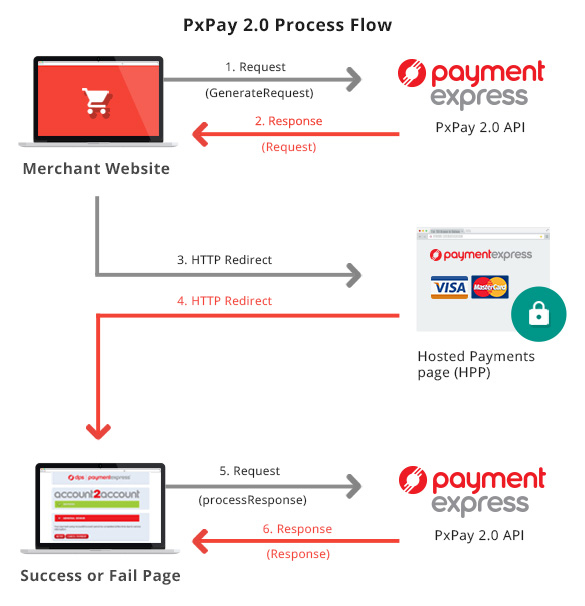

To process a transaction, PX Pay 2.0 allows merchants to send XML requests to Payment Express via HTTPS posts to https://sec.paymentexpress.com/pxaccess/pxpay.aspx.

PxPay Username & PxPay Key is required too.

For testing PxPay 2.0 on the UAT enviornment - please send XML requests to https://uat.paymentexpress.com/pxaccess/pxpay.aspx.

Payment Express responds with a unique URI (encrypted URL) for an SSL secure payments page. Please refer to Request Response Codes in case the URI is not returned.

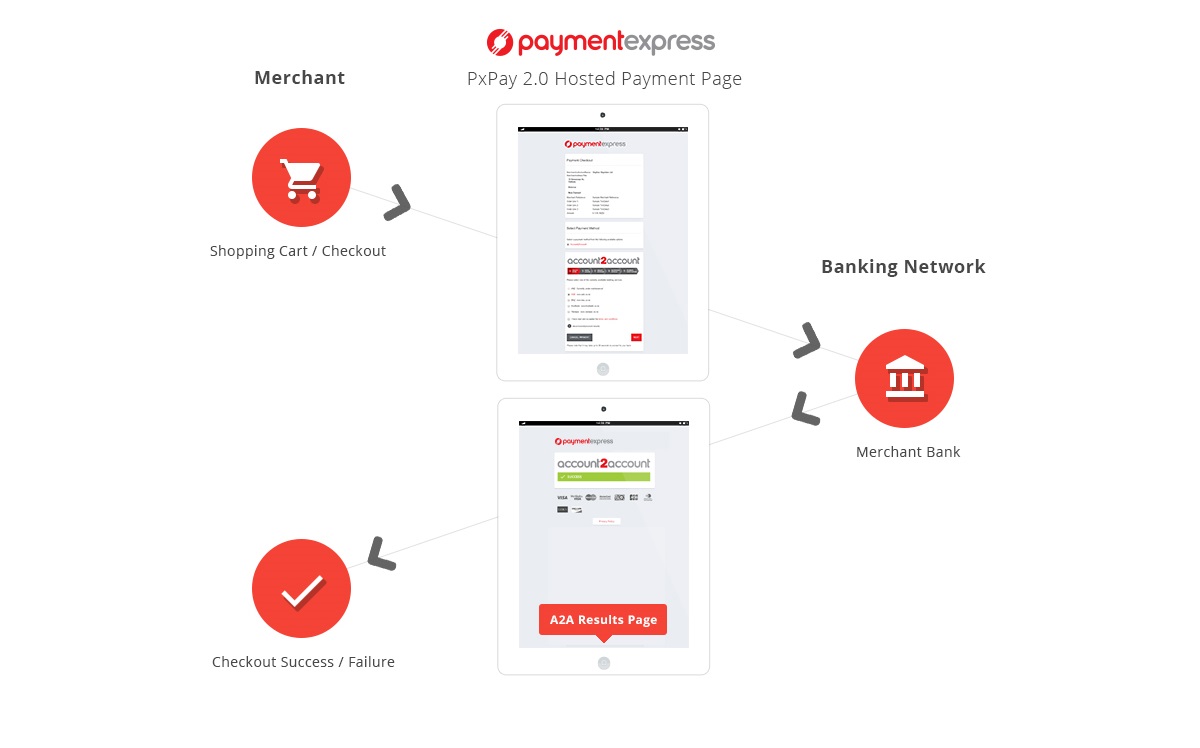

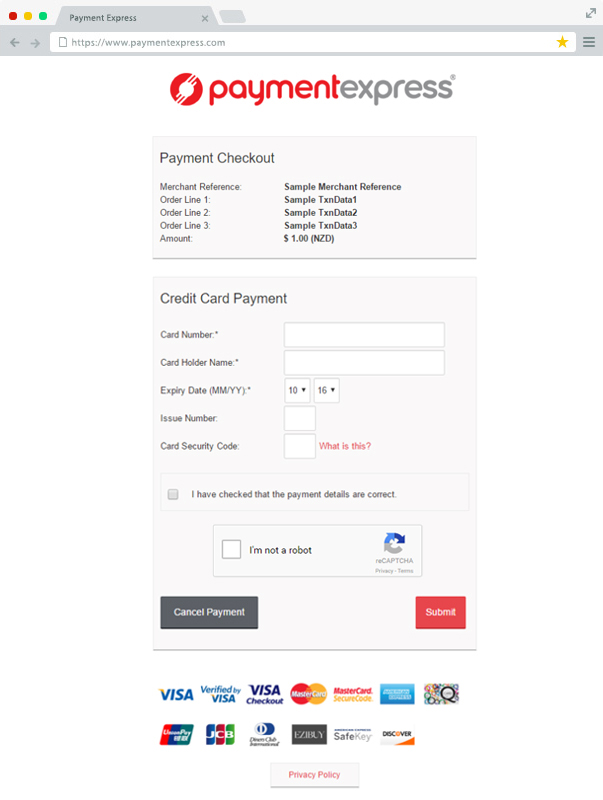

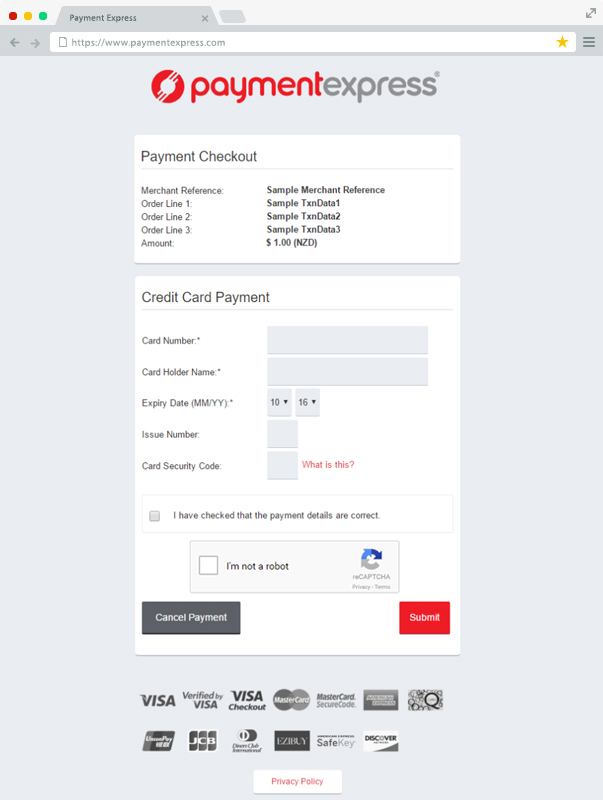

The merchant shopping cart uses the returned URI to redirect the customer to the secure Payment Express hosted payments page.

The customer will be prompted to enter their credit card details and complete the transaction. The transaction is then sent to the merchant bank for authorisation. The result is displayed and the user is automatically redirected back to the merchant's website (success or fail page); i.e https://demo.paymentexpress.com/SandboxSuccess.aspx?result=0000120000123476f1519ff80a123456&userid=SampleUserId

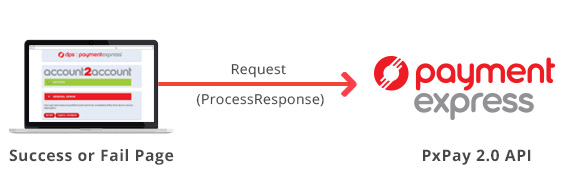

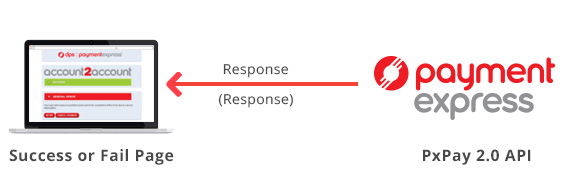

You take the "result" parameter value in the URL string i.e. 0000120000123476f1519ff80a123456 along with the PX Pay username and PX Pay key; to send the response request (ProcessResponse) to Payment Express and receive the XML response back.

The transaction results and other transaction details are decrypted and sent back to the merchant as a standard XML response.